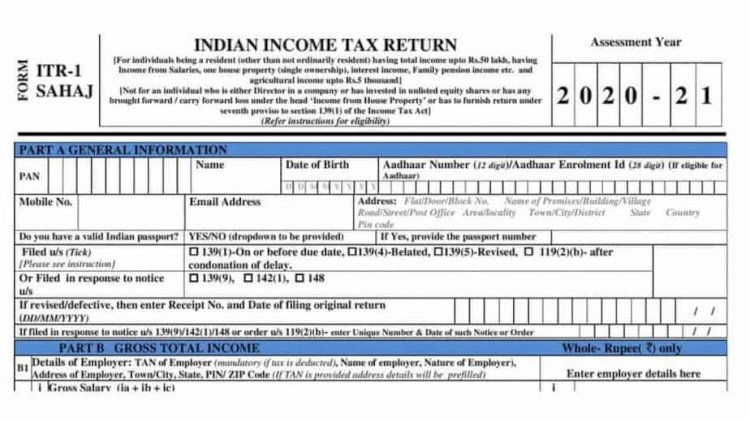

Changes in ITR AY 2020-21

Following are the changes in ITR forms for the FY 2019-20

- TAN of your employer - In ITR-1, additional information is required as compared to last year, detail of your employer. Until last year, a taxpayer simply had to select the nature of employment, i.e., Government, PSU, and Pensioners, Others from a drop-down menu in case of ITR-1.

The taxpayer will have to provide the Tax Deduction Account Number (TAN) of the employer, name, nature, and address of the employer are mandatory if tax is deducted.

These details will be pre-filled automatically, once TAN of the employer is filled by the taxpayer in ITR-1.

- In ITR-1, taxpayers will have to provide their passport number (if they have one). This is a new addition in Part A – General Information.

- If taxpayer, rented out a property, then the taxpayer will have to provide name and Aadhaar or PAN details of the tenant in ITR-1

- The taxpayer will now have to provide the complete address of house property in ITR-1 irrespective of whether it is self-occupied, deemed to let-out, or let-out. Earlier, these details were asked only in ITR-2 and ITR-3.

- If during the FY 2019-20, the taxpayer is required to provide the details of rent which were due but not received in FY 2019-20. Such information was earlier asked only in ITR-2 and ITR-3."

- An individual with a brought forward/carry forward loss under the head ‘Income from house property’ can no longer use ITR-1 to file his/her income tax returns.

- A separate column has been introduced under ‘Income from other sources’ for deduction u/s 57(iv) – in case of interest received on compensation or enhanced compensation under section 56(2)(viii).

- In ITR-4, these are additional details required by the income tax department from the taxpayers are as follows:

A taxpayer who spent an amount over 2 lacs on the travel of foreign trip;

Taxpayer deposited an amount of INR 1 crore in one or more current account;

The taxpayer has incurred an expenditure of an amount over INR 1 lacs as electricity bill

- The taxpayer filed their ITR through a representative thereafter Aadhaar number of the representative is required to be provided in ITR-4.

- Taxpayers will also have to disclose the following additional details in Part A- General information in ITR-4

- Whether the taxpayer is a partner of a firm? If yes, then furnish the name and PAN of the firm.

- Details of partners of the firm such as name, address, percentage of share in the firm, PAN, Aadhaar number, rate of interest on capital, and remuneration paid/payable.

- An individual taxpayer cannot file return either in ITR-1 or ITR4 if he is a joint owner in house property

- In case of 44AD or 44ADA or 44AE, now the taxpayer will be required to give an opening balance of cash in hand and opening balance of bank accounts and also the total amount received in cash during the year, the total amount deposited in the bank during the year, the total amount of cash outflow out of cash balance during the year, the total amount of withdrawal from the bank during the year and closing balance of cash in hand and closing balance in banks.

However, now there will be no need to provide figures of unsecured loans, sundry debtors, sundry creditors, amount of closing stock, etc. as were required in earlier years

What's Your Reaction?