REPORTING OF FOREIGN INVESTMENT THROUGH NEW FORM FIRMS OF RBI

The Reserve Bank, in the First Bi-monthly Monetary Policy Review dated April 5, 2018, announced that, with the objective of integrating the extant reporting structures of various types of foreign investment in India, it will introduce a Single Master Form (SMF) subsuming all the existing reports.

What is a Single Master Form (SMF)?

A master form that provides for the reporting of 9 forms for foreign investment viz., FC-GPR, FC-TRS, LLP-I, LLP-II, CN, DRR, ESOP, DI, InVi. With effect from September 1, 2018, five forms viz., FC-GPR., FC-TRS, LLP-1, LLP-II, and CN were made available. The other three forms viz., ESOP, DI, and DRR are being made available for filing with effect from October 23, 2018. Form InVi would be made available subsequently.

What is FIRMS form?

An online reporting platform for reporting of foreign investment in India in SMF. FEMA 20(R) prescribes for the reporting of foreign investment in India through various returns. FIRMS provides a one-stop-shop, 24*7 online reporting facility for the applicant.

Process of Registration for Business User.

Step 1. Go to the FIRMS website at https://firms.rbi.org.in

Step 2: At the Login box, click on the Registration form for New Business User.

Step 3: Fill up the details in the popped up registration form for Business User as below

|

Field Name |

Description |

|

First Name |

First Name of the Business User (BU) |

|

Middle Name |

Middle Name of the Business User (BU) |

|

Last Name |

Last Name of the Business User (BU) |

|

User Name |

User name for the Business User (BU). It shall be unique. |

|

|

Email ID of the Business User (BU) |

|

Confirm email |

Email ID of the Business User (BU) |

|

Phone No |

Mobile No of the Business User (BU) |

|

Address |

Correspondence Address of the Business User (BU) |

|

IFSC code |

Select the IFSC code of the Bank branch to whom the reporting would be made. This field shall be carefully selected so that the reporting is made to the correct branch of the bank. The applicant shall be versed with the working model of his/her bank for the foreign investment reporting in terms of the branches which are operating for the approval/rejection of the reported forms in the FIRMS application. Not all branches are incorporated in the FIRMS application, but only those as specified by the respective bank.

If the applicant is unable to find its respective branch under the IFSC code, he/she may contact its branch for clarification on this issue. |

|

Bank name |

Auto-populated as per the IFSC code selected |

|

Authority letter- Attachment |

Attachment in the specified format for Authority letter. It is common for all forms filing in SMF. Attach PAN card of the individual registering as a Business User |

|

Company CIN/LLPIN |

Select the CIN or LLPIN of the entity of which the foreign investment is being affected. i.e. the Indian investee company. |

|

PAN Number |

Auto-populated based upon CIN/LLPIN Selection |

|

Entity name |

Auto-populated based upon CIN/LLPIN selection |

Step-4: Click the Submit button. In case any error is displayed, rectify the same and click the Submit button.

Step 5: A Message “Record Saved Successfully” is displayed at the top of the Login box.

After BU submits the registration form, the same will have to be verified by the AD Bank Branch concerned. The approval/ rejection of the same would be communicated through email notification to the Business User (BU).

Note: In case the user does not receive any mail notification for approval/rejection of the registration within the next 48 hrs, he/she may contact by e-mail.

The second phase is to create the Business User which permits the user to report the transaction of foreign investment received at a time. Here, the user files various forms depending upon its criteria like FCGPR, FCTRS, Form DI, etc. The effect of this reporting can be seen on the Entity Master.

For the creation of Business, User following are the documents required to be attached:-

- Authorization Letter as per the format prescribed;

- KYC of the non- resident investor;

- Details of the Banking Branch

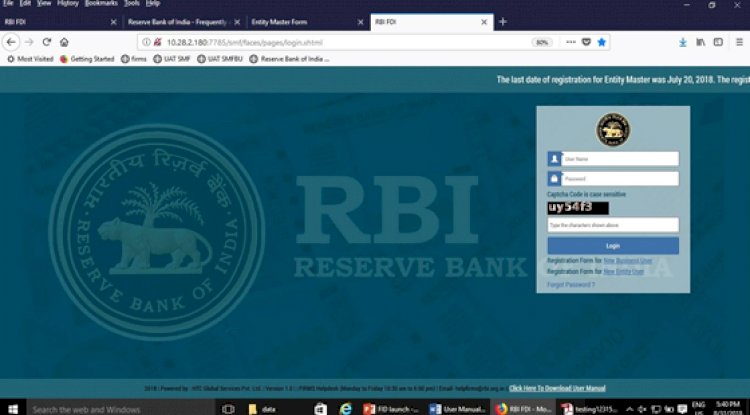

Process of Logging into FIRMS

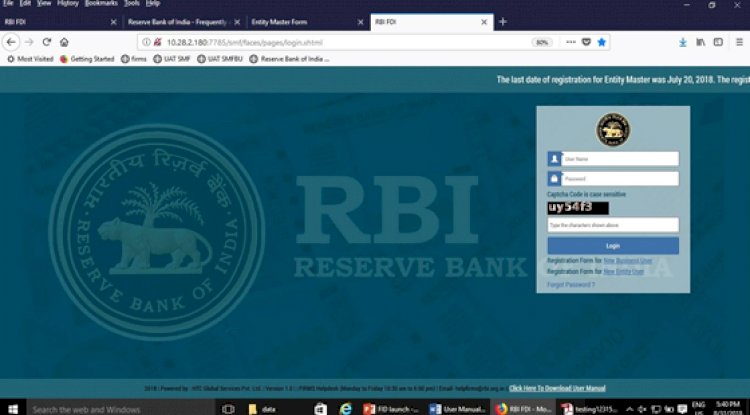

Step 1: Enter the User Name and default password as provided via email notification. Enter the captcha and click submit.

Step 2: Go to the FIRMS website at https://firms.rbi.org.in

Step 3: Upon first Login, Business User (BU) would be prompted to change the password through a pop- up window. Enter the details and submit. Upon success, Message “Password changed successfully” would appear on the Login Box.

Step 4: Enter a user name, new password, and captcha in the Login box and click submit. The user would be taken to his/ her workspace.

Upon subsequent logins, the Business user (BU) may enter a username, set password and captcha in the Login box, and click submit. The user would be taken to his/ her workspace.

What happens if a Business User Forgets his Password?

Do not need to worry about it you can easily forget the password by using the following step:

Step 1: Click on forgot password in the Login Box.

Step 2: Enter the username and registered email id in the pop-up window and click submit. An email would be sent to the email id with the default password. The user shall check its registered email id for the new default password and follow the steps under the head “Logging into SMF” for logging into SMF

What's Your Reaction?