NEW SCHEME UNDER LEAVE TRAVEL ALLOWNACE

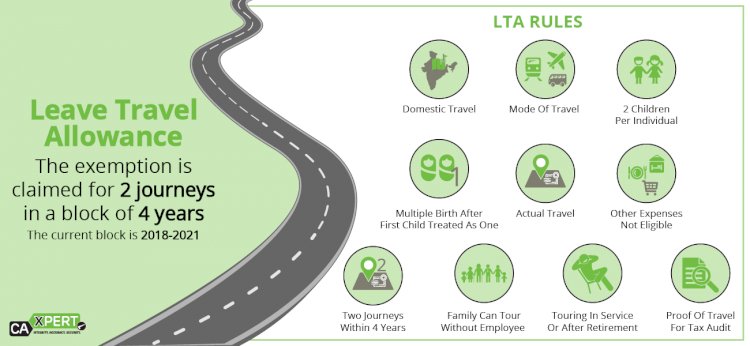

LEAVE TRAVEL ALLOWANCE

ABOUT:

Leave Travel Allowance is a tax exemption offered by employers to their employees. Leave Travel Allowance as the name suggests is an allowance paid to the employee by the employer when the former is travelling with their family or alone.

EXEMPTION:

How to claim Leave Travel Allowance exemption

in FY 2020-21:

Leave Travel Allowance or LTA allows individuals to claim tax exemption for a trip made within India for the taxpayer and his/her family. LTA can be claimed as tax exempt twice in a block of 4 calendar years. This allowance can be claimed via your employer by submitting tickets for a trip undertaken in India.

DETAILED EXPLANATION:

Normally employees are able to undertake at least some trips and are able to save taxes on the LTA portion. Due to the covid pandemic, hardly anyone has been able to claim LTA in FY 2020-21. To help employees save some tax on the LTA portion and to help boost sales of certain goods and services, the government launched the ‘LTA cash voucher scheme’.

LTA cash voucher scheme

Under this scheme, taxpayers can claim an exemption on LTA by spending a specified amount on certain goods without undertaking any trips.

As part of Budget 2021, the government has extended this benefit to all public and private sector employees.

WORKING OF

LTA Cash Voucher Scheme:

- This exemption shall be available for the FY 2020-21.

- Availing for this scheme shall count as usage of 1 trip (out of 2) allowed in the block of 4 calendar years 2018-21

- The taxpayer or a member of his family should have incurred ‘specified expenditure’.

- This ‘specified expenditure’ should have been spent on purchase of goods or services that attract a GST rate of 12% or more.

- Such a purchase should have been made between 12th October 2020- 31st March 2021.

- The exemption should not exceed Rs 36,000 per person or 1/3rd of the ‘specified expenditure’, whichever is less

- Payment for the expenses should have been made via electronic means and a ‘tax invoice’ should be available.

- In case you don’t avail of the scheme most employers either allow you to carry forward the amount to next year or pay it to you after deducting TDS on it.

Where to spend LTA money to claim exemption

|

Mobile Phones and Laptops |

18% |

|

Air Conditioners and Refrigerators |

28% |

|

Hotels |

18% |

|

Interior Decorator Services |

18% |

What's Your Reaction?